Already a Partner?

Sign in to the Partner Portal

Provide additional payment methods with no integration effort

$2+ billion processed

PaySimply™ has securely processed payments for billers and the Canada Revenue Agency.

Streamlined implementation

Sign up and start accepting payments. Optionally create Smart Payment Links.

Save money

Lower your processing costs for online payments with Interac e-Transfer and in-person options.

Provide payment choice

Access the cash economy, remote communities and the credit-challenged.

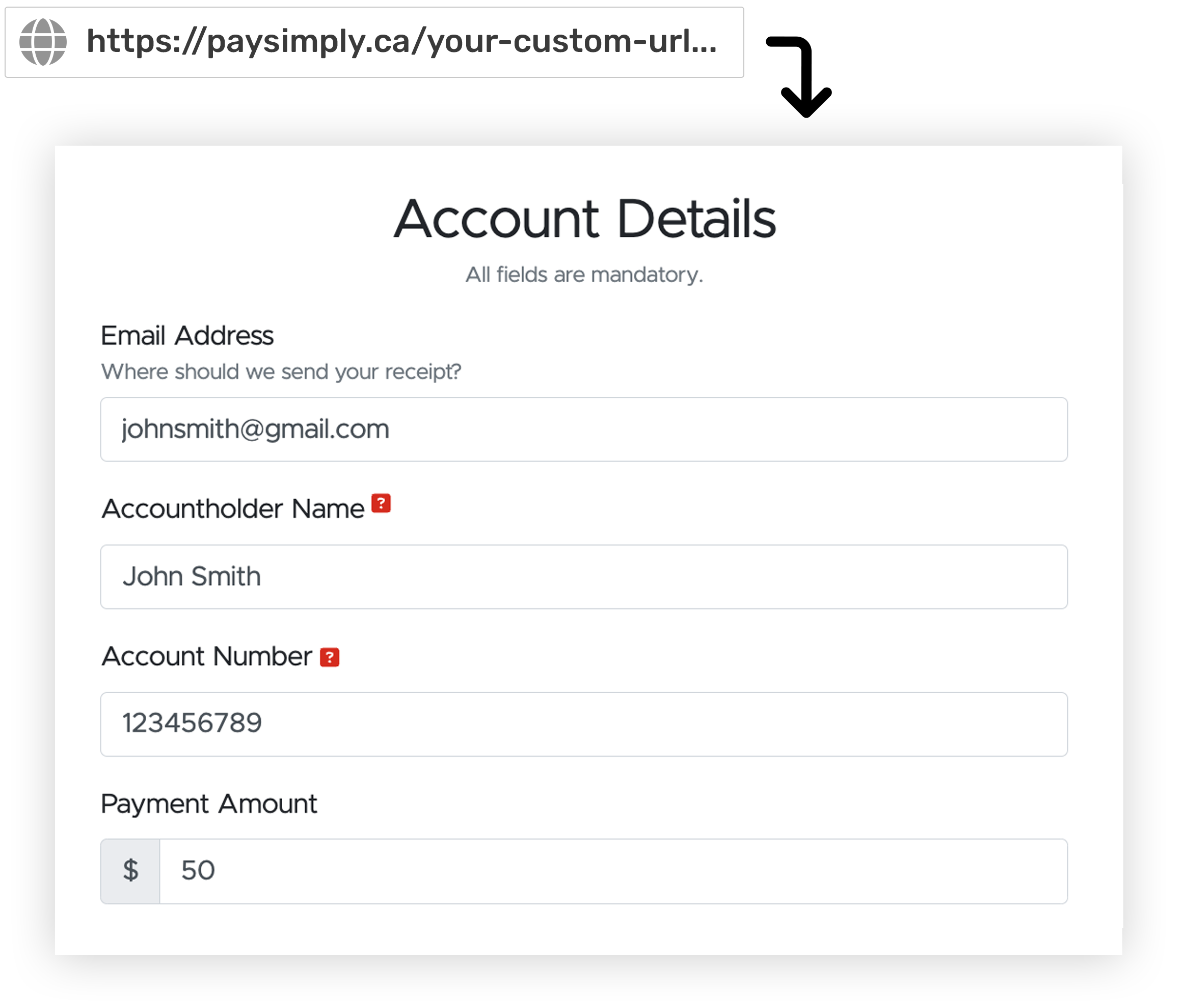

Create Smart Payment Links using our guideline

No API integration required.

- Speed up the payment process for your customers

- Automatically populates fields on PaySimply

- Optionally lock form fields and only allow one payment per link

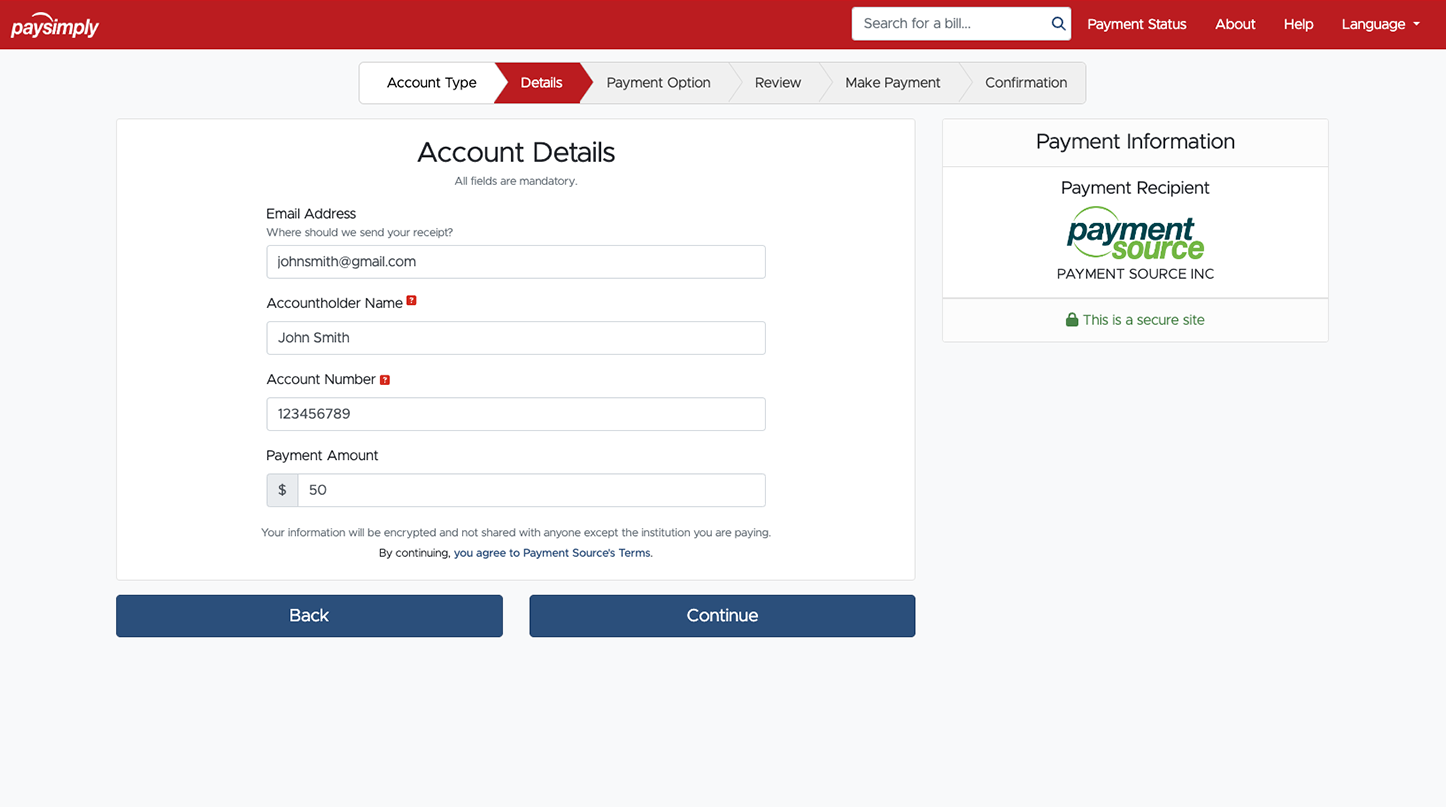

Payer experience

Directed to your dedicated landing page on PaySimply with a Smart Payment Link

Review pre-filled information from the Smart Payment Link

Select payment option

Make payment and receive receipt

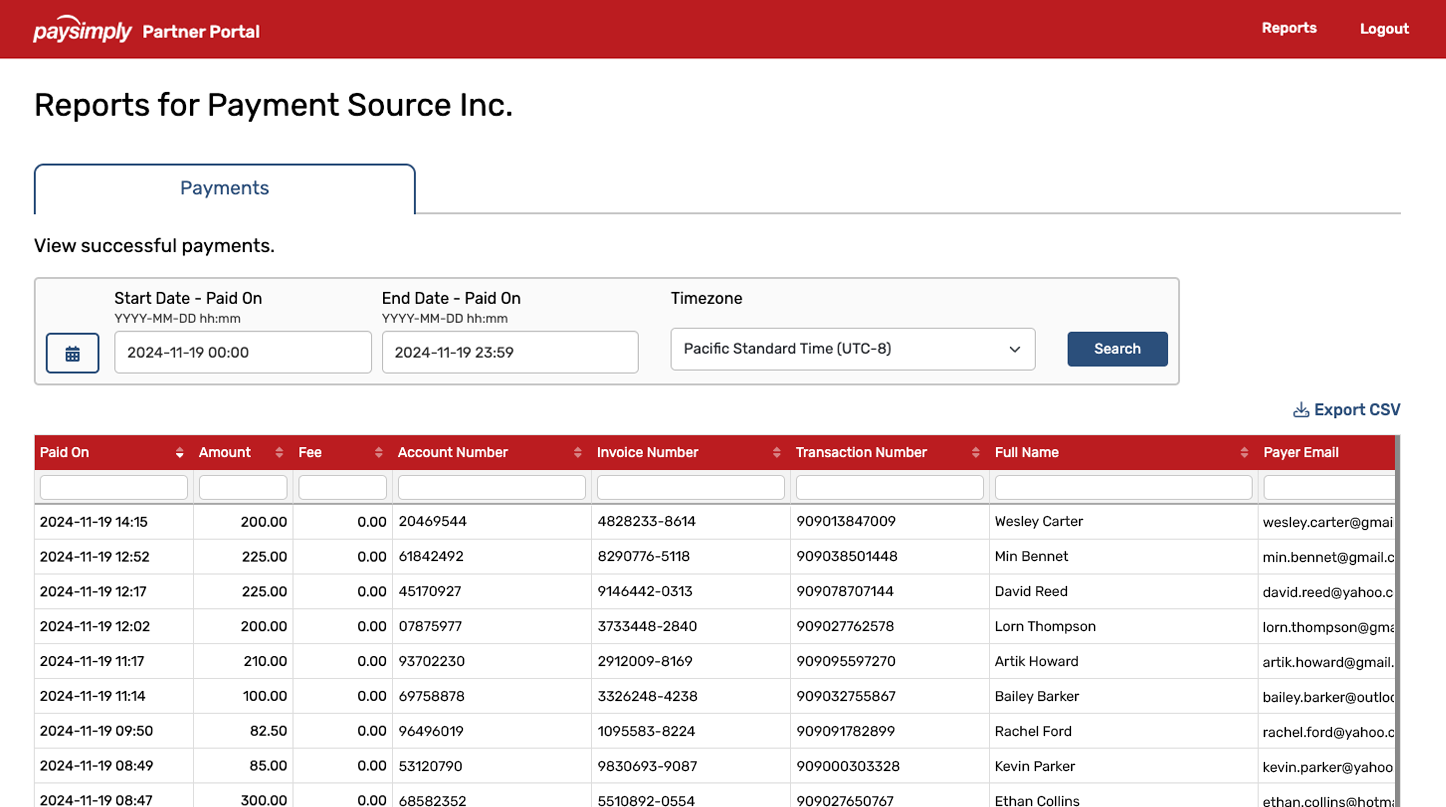

Partner support features

Dedicated landing page with your logo and custom URL

Monitor payments in the Partner Portal

Decide who pays the fees

- Your customer pays the transaction fees and it costs you nothing

- You pay the transaction fees and it costs the customer nothing

- Need a hybrid option? Talk to us

Configure your account details

- Up to 6 different form fields

- Reduce user errors with field validation

Choose which payment options you want to offer

- Credit and debit cards

- Interac e-Transfer

- PayPal

- In-person at the post office

Automatic settlement

- Funds are settled by EFT three days after the transaction

- FTP settlement file is available for high-volume partners

Talk to our sales team to get started

Let us help you find a solution that will work for your business.

Work with payment experts

Payment Source is an award-winning Canadian company with 20+ years of payments expertise.

$5+ billion

processed

73+ million

transactions processed

Organizations we work with